Visualising the catastrophic impact of your AI vulnerabilities. Select a vector below to see the potential impact.

> THREAT ASSESSMENT

> WAITING FOR SELECTION...

SOC 2 FOR AI RISK

From deadlock to delivery: governr delivers continuous AI risk protection for you with SOC2-grade trust so that you can deploy AI and neutralise the existential threats to your business.

Visualising the catastrophic impact of your AI vulnerabilities. Select a vector below to see the potential impact.

> WAITING FOR SELECTION...

Existing AI risk frameworks and standards struggle to keep pace with the rapid evolution of AI technology. The rapid evolution of AI systems, combined with complex regulatory requirements, creates significant compliance and operational risks.

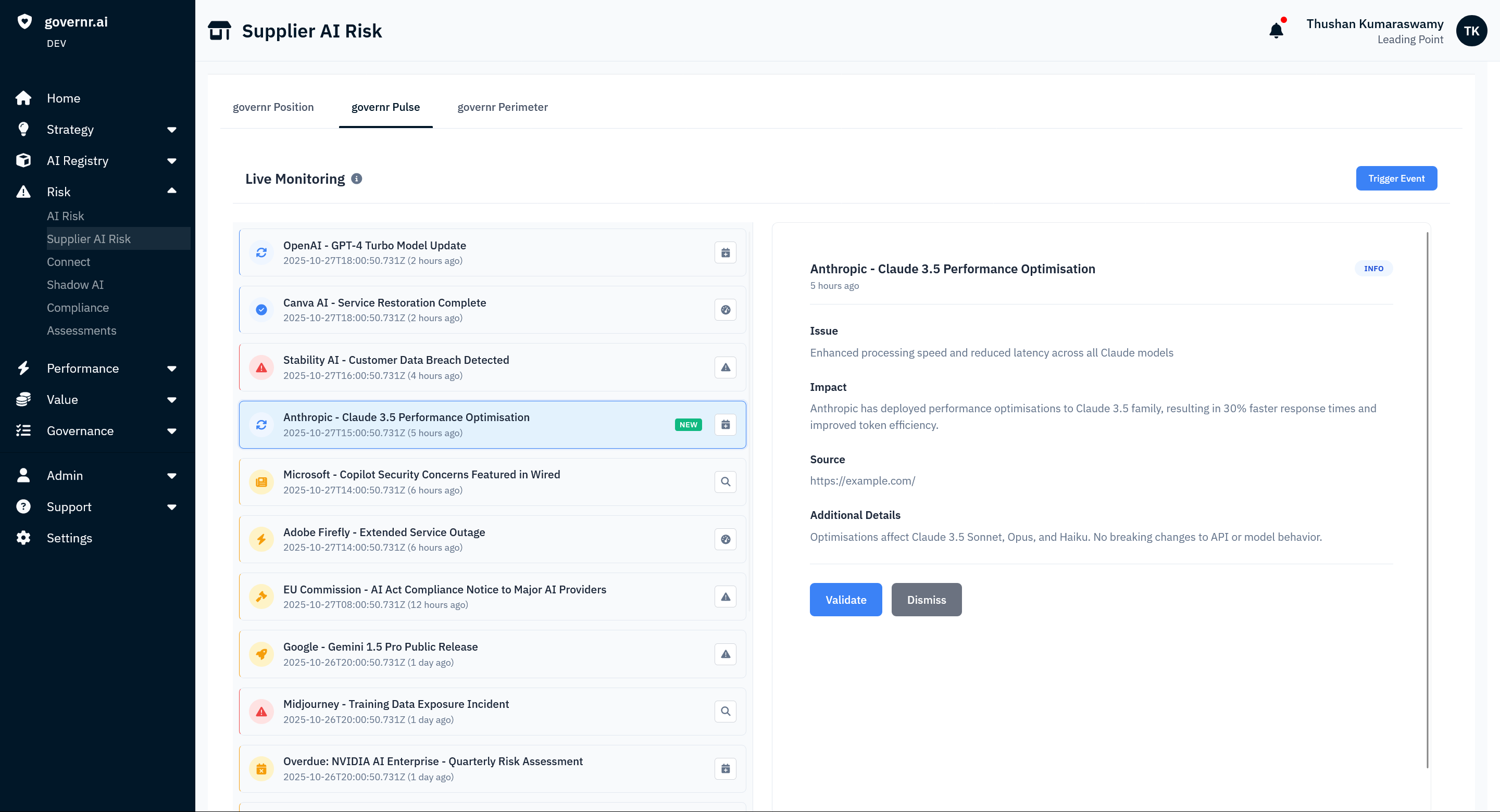

AI risks evolve rapidly, outpacing slow, periodic reviews and audits that miss emerging issues between assessments.

Frameworks like NIST AI RMF are often too theoretical and checklist-focused, lacking practical guidance for real-world AI risk management in financial services.

Regulatory standards lag behind fast-moving AI innovations, leaving gaps where new technologies and risks remain unaddressed or unclear.

Most risk frameworks lack real-time monitoring and automated controls, making it hard to detect and mitigate AI risks as they happen in live environments.

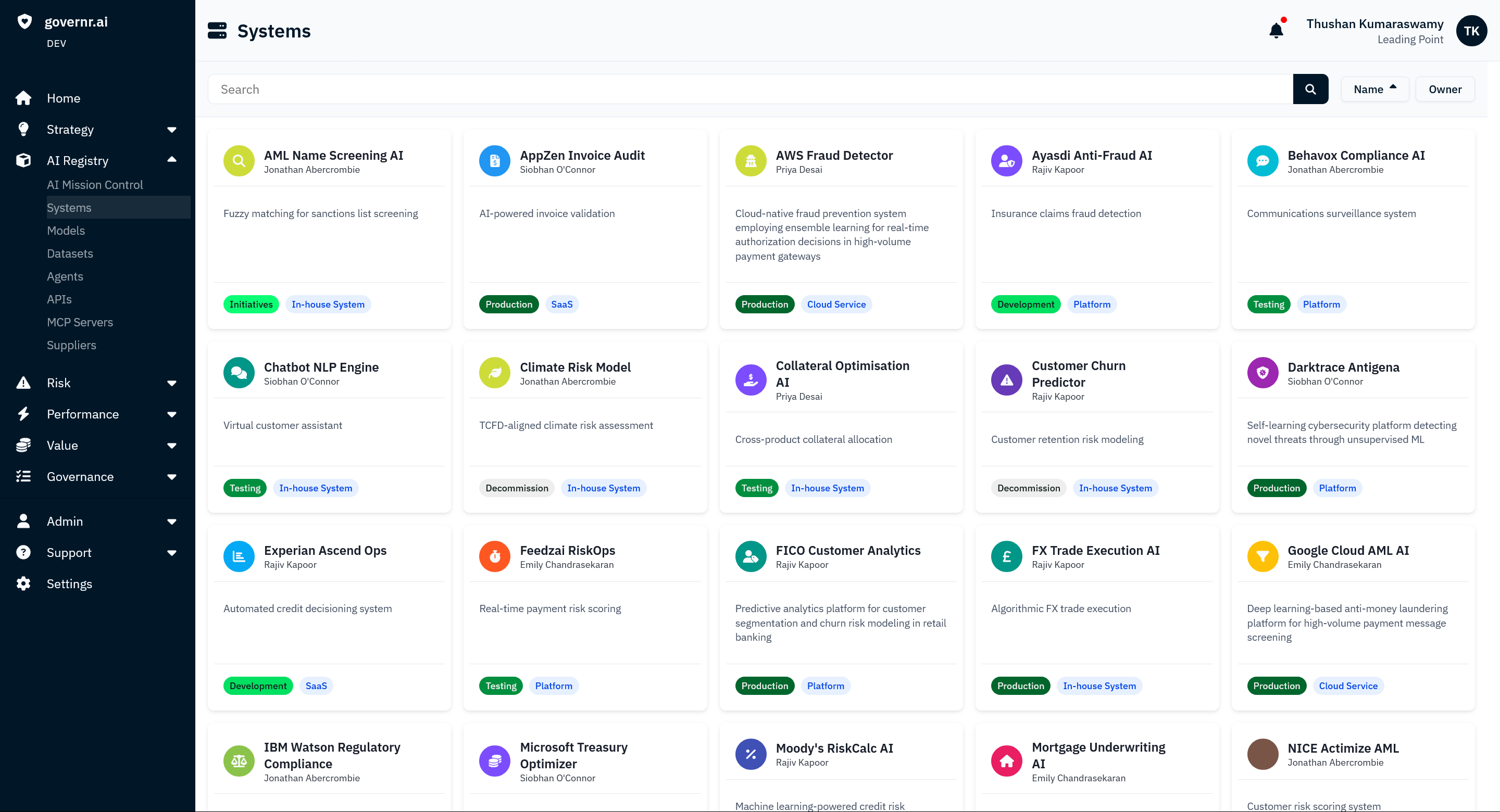

Give your risk teams the confidence to approve new AI projects. Start with knowing the AI assets you have, including shadow AI. Then use our market standard AI risk framework to get automated, real-time risk assessments.

Automated scanning and catalogue uploads build your AI asset inventory.

Track AI risk across all your AI assets in business context. See impacts on business, customers, action progress.

Live updates on supplier changes. See model changes, new regulations, data breaches. Portable reports for stakeholders.

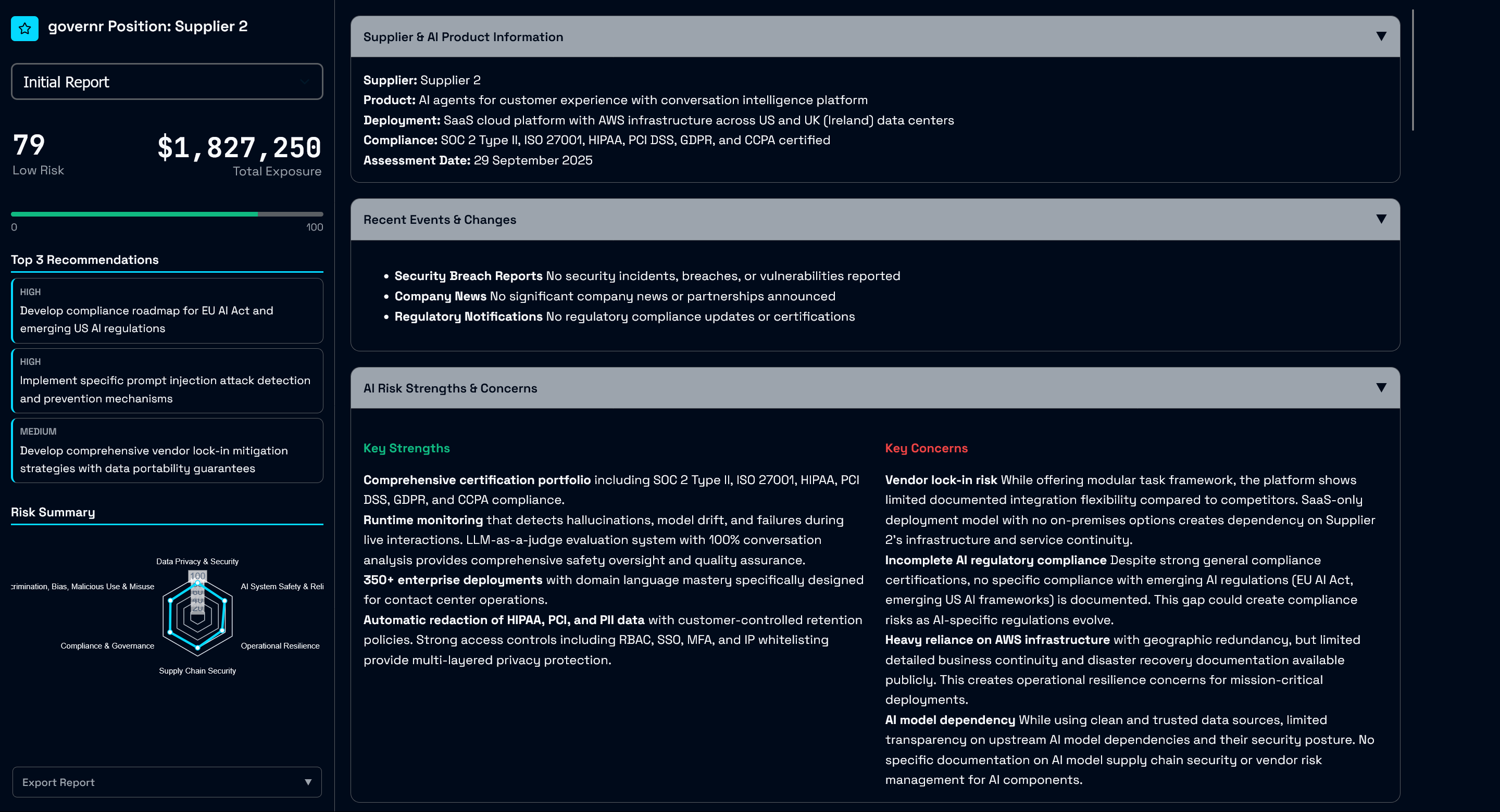

Calculate your AI risk exposure based on your business context; unique to you and how you use AI.

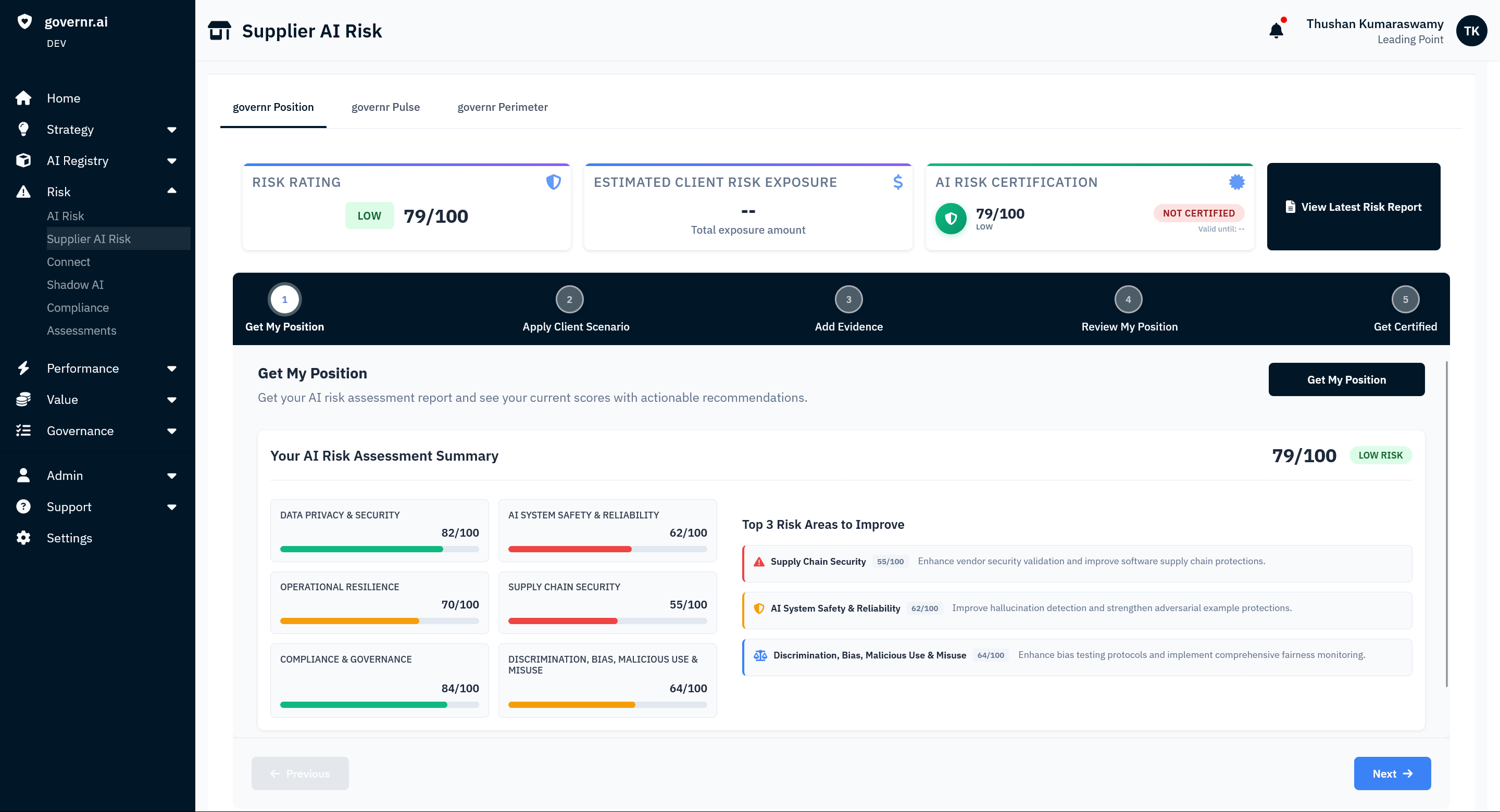

governr has built and implemented a world-class AI risk framework built on 80+ risk factors. Think SOC 2 for AI Risk. governr provides comprehensive AI risk assessment and profiling of your internal and third-party AI across six critical risks: Data Privacy & Security, System Safety & Reliability, Compliance & Governance, Discrimination, Bias & Misuse, Operational Resilience, and Supply Chain Security. In minutes than months. Designed to integrate with your risk frameworks and report to FINRA, SEC, FCA, MAS and major AI regimes.

Adjust sliders to see how different factors impact overall score and rating. See how selected provider scores compare to peer providers.

Our advisors are architects of modern risk management; former heads of risk, chief technology officers, and regulatory pioneers who have successfully navigated their organisations through technology revolutions and regulatory shifts. They bring battle-tested wisdom from frontlines of financial services transformation.

Choose visibility over vulnerability. Get transparency on AI risk today.